The credit score is highly beneficial if you are attempting to prepare for your financial future. Credit Karma for Credit Scores is one of the greatest and most well-known credit reporting websites/apps. It provides customers with free access to their Credit Karma for Credit Scores and credit reports, as well as enables consumers to evaluate financial items that they may qualify for, such as loans or credit cards, geared towards their credit level.

Credit Karma for Credit Scores is a wonderful beginning place for monitoring the health of your finances, but it has some limitations in terms of the Credit Karma for Credit Scores reference agencies that it works with and the tools that it offers.

Top 15 Best Sites & Apps Like Credit Karma for Credit Scores in 2022

If you’re looking for an alternative to Credit Karma for Credit Scores, explore some of the following possibilities. In the list below, we have studied and handpicked some outstanding alternative sites and applications comparable to Credit Karma for Credit Scores for credit reporting. The credit score of each customer is extremely crucial to their financial life.

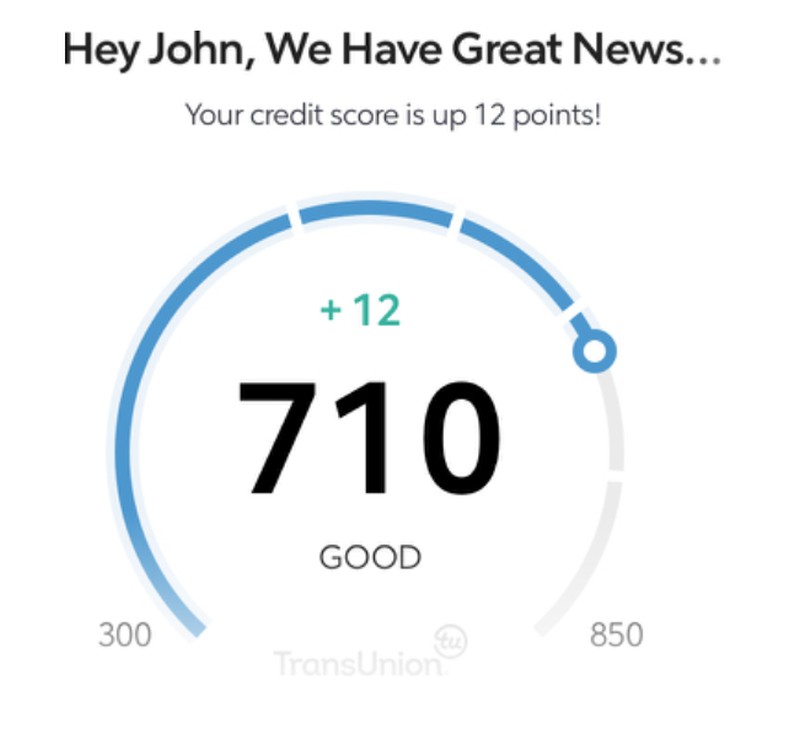

This score normally fluctuates between 300 and 850 and is dependent on numerous criteria like credit utilization, payment history, duration of credit history, and credit checks. Your credit is like your school grade. Creditors and even recruiters analyze it before they make their decision to loan you money or hire you. This Credit Karma for Credit Scores affects your ability to acquire a mortgage or buy a new automobile.

1. Credit

Credit.com is an app and browser-based credit score application that reports your Experian credit score. The app is free of charge, with no credit card necessary to establish an account. There is an Android and Google Play version of the app, and you can view the information via your web browser as well if you like. In addition to informing you of your score, Credit will also explain how scores are calculated and provide customers with tips on how to improve their scores. The tool is beneficial for credit education and repair, and since you can set up alerts, it helps in the battle against identity theft as well.

2. Credit Sesame

Credit Sesame touts itself as a customized credit management service that helps consumers improve their credit rating and their overall finances. It leverages TransUnion to present a clear and easy-to-understand review of the elements that determine a person’s credit rating. It also offers a service that helps consumers pick credit cards or loans that are suited to their circumstances.

This might be advantageous for consumers with a solid credit rating, enabling them to locate the best prices on the market. It is also beneficial for individuals in the process of growing their credit rating, as it will enable them to choose the financial products that provide the greatest cost and the highest possibility of getting accepted with their existing score.

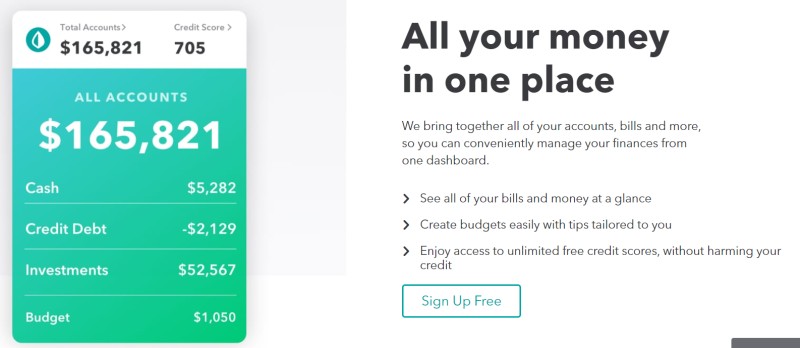

3. Mint

Mint is an app that enables budgeting, bill paying, and investment monitoring all in one easy tool. It also offers credit scores, free of charge, with credit notifications anytime TransUnion gets information that can affect your credit score. This implies that it helps you not simply keep track of your current score for borrowing purposes; it also serves as an early warning sign for identity theft.

If you are alerted that your score has changed because someone else created an account and that person wasn’t you, then you will be able to take action promptly-ideally before your credit score is substantially impacted.

4. Annual Credit Report

While most of the goods and services on this list give limitless reports from one single agency, the Annual Credit Report works slightly differently. This service gives consumers a free report from each of the three main credit reference agencies: Experian, TransUnion, and Equifax, once per year. This is beneficial for consumers who will be investigating the market for a substantial purchase such as a mortgage, as it helps potential borrowers make sure that their financial facts are correct across all the major credit reporting groups.

5. Equifax

If you only want a bare-bones report and don’t want to disclose your personal data to a middleman in order to receive it, then you have the option of going straight to the credit reference companies themselves. Equifax allows consumers to get six free credit reports each year. This is a bare-bones service. There are no loan or credit card matching tools, and no warnings. The upside, though, is that you are going right to the source. This implies a reduced chance of spam or marketing calls from the makers of the applications or the individuals who are attempting to pitch loans.

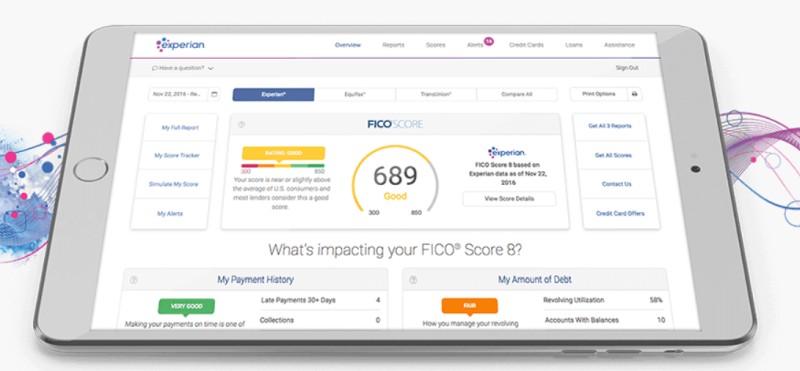

6. Experian

Experian CreditWorks Premium is an aid-for program that monitors Experian, TransUnion, and Equifax credit reports daily, and then tells users if they have changed. The credit score is based on the FICO Score 8 for most of the computations, although for specific forms of credit, different scores may be utilized. This tool is a fantastic alternative for those who want to optimize their credit score, those who are considering a house purchase soon, and those who are worried about identity theft. There is a monthly subscription, but the first month has a cheap introductory price, allowing consumers to trial the service with minimum risk.

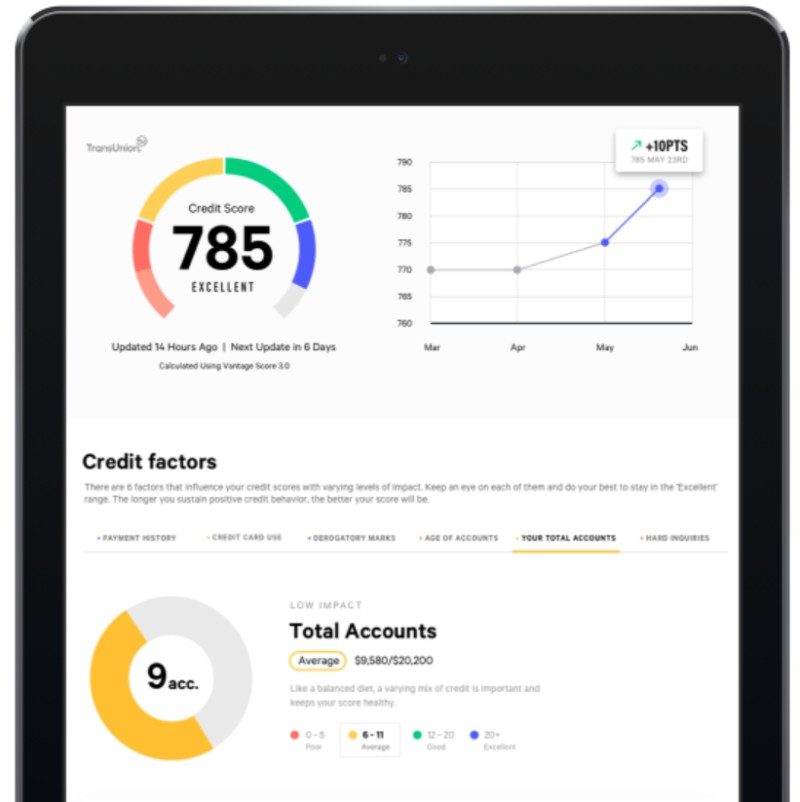

7. TransUnion

TransUnion allows individuals to request one credit report each year, free of charge. Everyone who does not currently use a credit reporting tool should consider taking advantage of this. If you want more than one report per year from TransUnion, then you may sign up for their year-round service, which allows you to see your credit report as frequently as you desire. This service also alerts you if there are new accounts created in your name, changes to your credit card balance, or any unfavorable reports filed by creditors.

8. CreditWise

CreditWise is a free credit monitoring app that is manufactured by Capital One. While the app is produced by a lender, setting up an account with it doesn’t harm your credit score. The site features some very helpful tools, such as a simulator that allows you to see what is likely to happen if you make certain changes to your financial habits, such as paying off a debt or increasing the limit on one of your credit cards. This is a beneficial sort of financial education, which may aid you as you prepare yourself to make large loan applications in the future months or years.

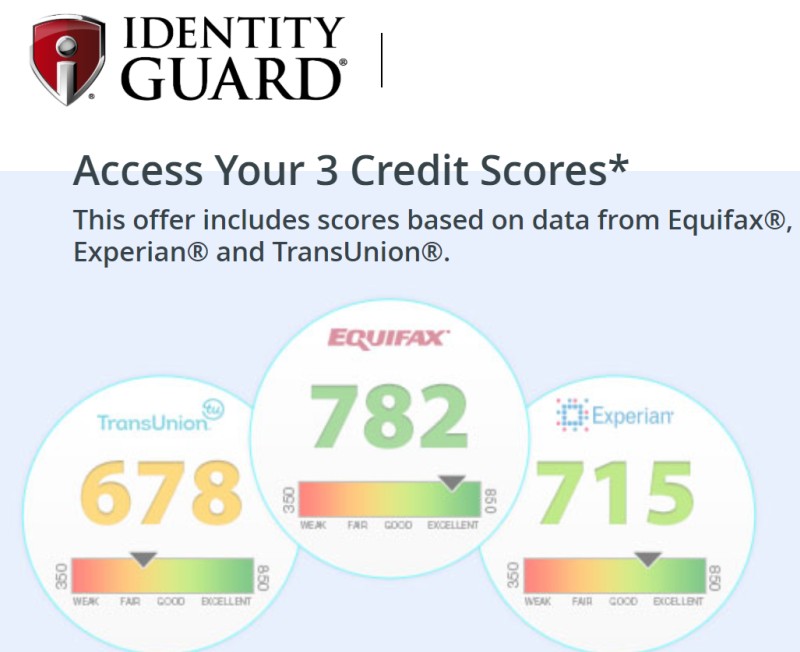

9. Identity Guard

IdentityGuard is a technology that helps to safeguard users against identity theft. It is easy to set up an account, and once you are up and running, you can get notifications about large changes to your credit record, providing you with an early warning in the event of probable fraud. One especially great feature about the service is that it offers tiered pricing, with the option of signing up for a family account and protecting not only your personal financial information but that of your husband and children as well. Credit accounts made using a child’s SSN are a popular fraud these days and one that many young individuals only find out about when they start their own financial life.

10. Bankrate – Quizzle

Bankrate-Quizzle is a credit report product that was built after Quizzle was bought by the Bankrate team. This credit improvement tool gives credit reports, charts, and a discussion of the elements that are affecting your credit score. Signing up for an account is free, and the tool includes access to your entire credit report with weekly updates on your score, alerts when your credit report changes and tracking features to help you understand how your credit score is evolving over time. The tool also gives customized prices for financial items.

11. WalletHub

WalletHub offers free credit scores, updated on a daily basis, along with free credit reports and a study of the elements that go into producing your credit score. The tool is accessible via a website and also a mobile app. Signing up is simple and straightforward, and the service will allow you to identify credit cards, rewards cards, loans, and mortgages that could be acceptable for you depending on your existing credit score. Most free credit score programs give just weekly or monthly updates, so having access to a daily update makes this an intriguing alternative.

12. Discover Card FICO Score

This application from Discover gives customers a FICO score based on information from TransUnion. FICO scores are the most commonly used scores by major lenders. The score is based on the amount of money due, the duration of the person’s credit history, how much new credit has recently been established, and the nature of that credit. Discover gives customers a score that is updated on a regular basis, with the date that the score was changed being presented on the dashboard.

The score is a snapshot and may not be updated as regularly as some other tools, but it is free to view and an excellent alternative for anyone wishing to understand what information TransUnion has on their records.

13. Chase Credit Journey

Chase Credit Journey is a free credit score reporting tool that is available to anybody who wants to check their score, even if they are not a Chase client. The software refreshes weekly, and users may check their scores as often as they desire without having to worry about the check adversely damaging their scores. The application also includes a free score simulator that helps consumers understand how changing their financial habits can affect their scores in the future. Users may also be presented with options for loans or credit cards that match their finances.

14. PrivacyGuard

PrivacyGuard is a premium identity theft prevention program that incorporates credit reporting, score tracking, and credit education services. There is a reasonable introductory deal for the service, allowing consumers to check it out without paying a lot of money. Users gain access to their VantageScore and may request notifications for big changes such as bad marks on their account, substantial balance changes, or new accounts being established in their name. There is also the option of daily credit monitoring that follows all three of the main credit reference bureaus.

15. Rocket HQ

Rocket HQ is a free application that enables users to access their TransUnion credit report and allows them to follow their VantageScore. The program includes a range of financial education tools to assist individuals understand how their credit and personal finances function, and also offers answers to frequently asked questions concerning things like mortgages and loans. Rocket HQ is free to use, and monitoring your credit score using the service will not leave any substantial notes on your credit report, so you may monitor your score as frequently as you desire.